Each year we use less cash in daily transactions, but at the same time the amount of banknotes in circulation inside the Eurozone is increasing at a rapid rate. Last year, the total value of all banknotes in circulation reached €1,08 trillion, an increase of 6,5% compared to the year before. The total value of all banknotes in circulation in fact doubled in ten years, in increase that could only partially be explained by inflation and the entrance of new member states to the Eurozone.

More than €1 billion of banknotes inside the Eurozone

More cash in circulation

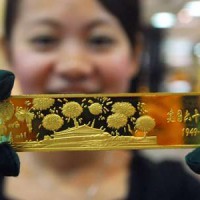

What explains the increasing demand for banknotes? It could be the result of a growing black market economy, in which goods and services are paid for in cash and cannot be traced afterwards. But in recent years, distrust towards banks and the extremely low interest rate could also explain the flight to cash. Persistent rumors of a possible tax on savings, the new ‘bail-in’ scheme for European banks and the fact that you earn almost no interest on bank deposits make it more attractive to keep savings in the form of cash. We can also imagine people wanting to get out of the financial system by holding cash and buying gold.

Savings

The ECB publishes the number of banknotes in circulation inside the Eurozone, so we collected the data since the introduction of the euro in 2002. The graphs show that there has been a substantial increase in the €500 denomination, which confirms our view that there has been in increasing number of savers taking money out of banks and holding physical banknotes instead. Banknotes of €500 are not suitable for daily transactions, because most stores simply do not accept them. The increase of the largest denomination suggests that savings are already moving out of the banking system in increasing amounts.

The €500 banknotes appear to be in strong demand

Almost 30% of all cash in circulation (in value) is a €500 note